Filed Pursuant to Rule 424(b)(3)

Registration No. 333-260528

PROSPECTUS

Mirion Technologies, Inc.

Up to 8,560,540 Shares of our Class A Common Stock Issuable upon Redemption of Shares of IntermediateCo Class B Common Stock

Up to 27,249,979 Shares of our Class A Common Stock Issuable upon Exercise of Warrants

143,250,440 Shares of our Class A Common Stock for Resale by the Selling Holders

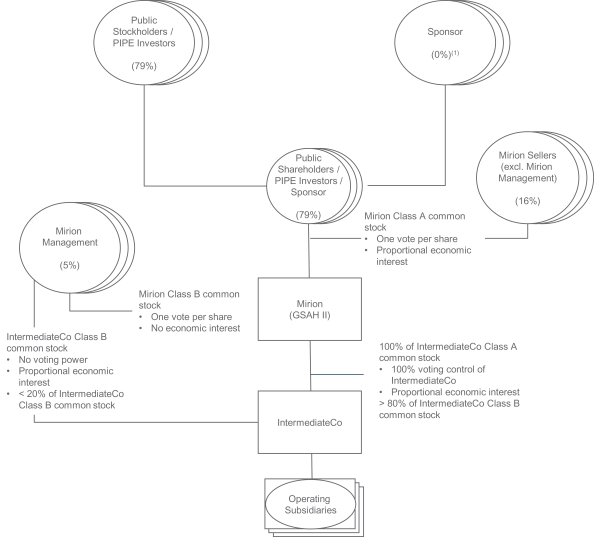

This prospectus relates to: (1) the issuance by us of up to an aggregate of 35,810,519 shares of Class A common stock, par value $0.0001 per share (“Class A common stock”), of Mirion Technologies, Inc. (the “Company”) that may be issued upon (i) the exercise of 27,249,979 warrants to purchase Class A common stock at an exercise price of $11.50 per share of Class A common stock, including the public warrants and the private placement warrants (each as defined below), and (ii) the exchange of up to 8,560,540 shares of Class B common stock, par value $0.0001 per share (the “IntermediateCo Class B common stock”), of Mirion IntermediateCo, Inc. (“IntermediateCo”); and (2) the offer and sale, from time to time, by the selling holders identified in this prospectus (the “Selling Holders”), or their permitted transferees, of up to 143,250,440 shares of Class A common stock.

This prospectus provides you with a general description of such securities and the general manner in which we and the Selling Holders may offer or sell the securities. More specific terms of any securities that we and the Selling Holders may offer or sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus.

We will not receive any proceeds from the sale of shares of Class A common stock by the Selling Holders pursuant to this prospectus or from the sale of shares of Class A common stock by us pursuant to this prospectus, except with respect to amounts received by us upon exercise of the warrants to the extent such warrants are exercised for cash. However, we will pay the expenses, other than underwriting discounts and commissions, associated with the sale of securities pursuant to this prospectus.

Our registration of the securities covered by this prospectus does not mean that either we or the Selling Holders will issue, offer or sell, as applicable, any of the securities. The Selling Holders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide more information in the section entitled “Plan of Distribution.”

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities.

Our Class A common stock and warrants are traded on the New York Stock Exchange (“NYSE”) under the symbols “MIR” and “MIR WS,” respectively. On March 10, 2022, the closing price of our Class A common stock was $8.15 per share and the closing price of our warrants was $1.75 per warrant.

Investing in our securities involves risks. See “Risk Factors” beginning on page 19 and in any applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 11, 2022.