UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

___________________________________

| | | | | |

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| | | | | |

Check the appropriate box: |

| |

| ☐ | Preliminary Proxy Statement |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☒ | Definitive Proxy Statement |

| | |

| ☐ | Definitive Additional Materials |

| | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

MIRION TECHNOLOGIES, INC.

_________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| ☒ | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | 1 | | Title of each class of securities to which transaction applies: |

| | | 2 | | Aggregate number of securities to which transaction applies: |

| | | 3 | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | 4 | | Proposed maximum aggregate value of transaction: |

| | | 5 | | Total fee paid: |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1 | | Amount Previously Paid: |

| | 2 | | Form, Schedule or Registration Statement No.: |

| | 3 | | Filing Party: |

| | 4 | | Date Filed: |

1218 Menlo Drive

Atlanta, GA 30318

Telephone: (770) 432-2744

April 20, 2022

Annual Meeting of Stockholders — June 15, 2022

Dear Fellow Stockholders:

We are pleased to invite you to join us for Mirion’s first ever Annual Shareholders’ Meeting. The meeting is scheduled to take place virtually on Wednesday, June 15, 2022 at 10:00 a.m. (Eastern Time), via live webcast at www.virtualshareholdermeeting.com/MIR2022.

Fiscal 2021 was a historic year for Mirion as we completed the long-anticipated process of becoming a public company. Our teams worked diligently to make this a reality and we have enjoyed getting back to our core mission.

We thank you all for your investment in Mirion and your continued support as we look to build off our strong demand momentum from 2021.

Our revenue for fiscal 2021 was $668 million, and adjusted revenue was $683 million(1). Net loss was $23 million for the successor period from October 20, 2021 through December 31, 2021 and $205 million for the predecessor periods from January 1, 2021 through October 19, 2021. Our adjusted EBITDA for fiscal 2021 was $165 million(1). At the close of fiscal 2021, our order backlog stood at a healthy $748 million, pointing to continued engagement across our business. Our prospects are a clear testament to the hard work and effort put in by our Mirion teammates across the globe and the strong relationships that we maintain with our customers.

Mirion boasts a diversified product portfolio and holds a defensible position as the market leader in 14 of the 17 major product categories that we serve. We believe that the company has a clear strategy for growth and is well positioned going forward. We are focused on delivering commercial and pricing excellence in all facets of our business and have identified a series of meaningful cost savings initiatives, several of which are currently underway.

We believe that the future holds great things for Mirion, our business partners and our customers. Our teams stand committed to executing on our company’s mission of utilizing our unrivaled knowledge of ionizing radiation to protect people, communities and the environment for the greater good of humanity. Our products and services enable the implementation of lifesaving medical procedures and diagnostics, the safe production of carbon-free nuclear power and the protection of the men and women serving on the front lines in the armed forces and national defense ministries.

On behalf of Mirion’s 2,600+ employees and our Board of Directors, we thank you again for your continued support and investment in Mirion. Your vote is very important to our company, and we want to encourage you to please cast your vote on the important items that are up for consideration ahead of our first ever Annual Shareholders’ Meeting. Voting instructions and items on the ballot are listed in the accompanying proxy statement.

Respectfully,

Thomas D. Logan Lawrence D. Kingsley

Chief Executive Officer Chairman of the Board

| | | | | |

| _______________________________ |

(1) | Further information regarding non-GAAP metrics and reconciliations to the nearest GAAP measures are set forth in Appendix A to this proxy statement. |

1218 Menlo Drive

Atlanta, GA 30318

___________________________________________________

Notice of Annual Meeting of Stockholders

___________________________________________________

Wednesday, June 15, 2022

10:00 a.m. Eastern Time

Notice is hereby given that the 2022 annual meeting of stockholders (the “Annual Meeting”) of Mirion Technologies, Inc., a Delaware corporation (the “Company,” “Mirion” or “we”), will be held on June 15, 2022 at 10:00 a.m. (Eastern Time), via live webcast at www.virtualshareholdermeeting.com/MIR2022. The principal business of the Annual Meeting will be to:

1.Elect directors for a one-year term;

2.Ratify the appointment of Deloitte & Touche, LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2022;

3.Approve, on an advisory basis, the compensation of our named executive officers as disclosed in the accompanying proxy statement;

4.Approve, on an advisory basis, the frequency of future stockholder advisory votes on the compensation of our named executive officers;

5.Transact any other business as may properly come before the meeting or any adjournment or postponement thereof.

You can vote at the Annual Meeting in person or by proxy if you were a stockholder of record at the close of business on April 18, 2022. You may revoke your proxy at any time prior to its exercise at the Annual Meeting. To facilitate voting, Internet and telephone voting are available. The instructions for voting are on the proxy card. If you hold your shares through a bank, broker or other holder of record, please follow the voter instructions you received from the holder of record.

In light of the continuing COVID-19 pandemic (referred to as “COVID” or “pandemic”), the 2022 Annual Meeting will be virtual. You may attend the Annual Meeting and vote your shares electronically during the Annual Meeting via live webcast at www.virtualshareholdermeeting.com/MIR2022. You will need the 16-digit control number that is printed on your proxy card, voter instruction form or notice of internet availability of proxy materials, to enter the Annual Meeting. Mirion recommends that you log in 15 minutes before the Annual Meeting to ensure you are logged in when the Annual Meeting starts.

We are electronically disseminating Annual Meeting materials to our stockholders, as permitted under the "Notice and Access" rules approved by the Securities and Exchange Commission. Stockholders who have not opted out of Notice and Access will receive a Notice of Internet Availability of Proxy Materials containing instructions on how to access Annual Meeting materials via the Internet. The Notice also provides instructions on how to obtain paper copies if preferred.

Your vote is important. Please act as soon as possible to vote your shares.

| | | | | | | | |

| | | By Order of the Board of Directors, |

| | | Emmanuelle Lee Executive Vice President, Secretary and General Counsel |

Atlanta, GA

April 20, 2022

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on June 15, 2022:

The Notice of Annual Meeting, Proxy Statement and our

2021 Annual Report to Stockholders are available electronically at

www.proxyvote.com

PROXY SUMMARY

This Proxy Summary highlights information contained elsewhere in this proxy statement and does not contain all of the information that you should consider. Please read the entire proxy statement carefully before voting.

We are providing you with these proxy materials because the Board of Directors of Mirion Technologies, Inc. (the “Board”) is soliciting your proxy to vote at Mirion’s 2022 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements thereof, to be held via a live audio webcast on Wednesday, June 15, 2022 at 10:00 a.m. Eastern Time. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/MIR2022.com where you will be able to listen to the meeting live, submit questions and vote online.

You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply follow the instructions below to submit your proxy. The proxy materials, including this Proxy Statement and our 2022 Annual Report, are first being distributed and made available on or April 20, 2022.

As used in this Proxy Statement, references to “we,” “us,” “our,” “Mirion” and the “Company” refer to Mirion Technologies, Inc. and its subsidiaries. Our fiscal year end is on December 31 and our year ended December 31, 2021 is referred to herein as “fiscal 2021“ or “FY2021“. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

To assist you in reviewing the proposals to be acted upon at the Annual Meeting, we call your attention to the following information. The following description is only a summary.

Meeting Details

| | | | | |

| Time and Date: | June 15, 2022 at 10:00 a.m. Eastern Time |

| Place: | Virtual Meeting (via live webcast at www.virtualshareholdermeeting.com/MIR2022) |

| Record Date: | April 18, 2022 |

| Voting: | Stockholders of Mirion as of the record date are entitled to vote. Each share of Mirion Class A and Class B common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted upon at the Annual Meeting. Stockholders will vote together as a single class. |

Meeting Agenda

| | | | | | | | | | | |

| No. | Proposal | Board Voting Recommendation | Page |

| 1 | Election of Directors

Elect nine directors to our Board of Directors, each for a term of one year expiring at the 2023 annual meeting of stockholders and until such director's successor has been duly elected and qualified;

| FOR

(each nominee) | |

| 2 | Independent Auditor

Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022;

| FOR | |

| 3 | Say-on-Pay

Approve, on an advisory basis, the 2021 compensation of our named executive officers as disclosed in the accompanying proxy statement; and

| FOR | |

| 4 | Frequency of Say-on-Pay

Approve, on an advisory basis, the frequency (i.e., every one, two or three years) of future advisory votes to approve the compensation of our named executive officers. | ONE YEAR | |

QUESTIONS AND ANSWERS

Why am I receiving these materials?

The Board of Directors of Mirion Technologies, Inc. is making these proxy materials available to you on the Internet or, upon your request, by delivering printed versions of these materials to you by mail, in connection with the solicitation of proxies for use at our 2022 Annual Meeting of Stockholders (the "Annual Meeting"), or at any adjournment or postponement of the Annual Meeting.

The Annual Meeting will occur on June 15, 2022 at 10:00 a.m. Eastern Time via live webcast at www.virtualshareholdermeeting.com/MIR2022.

What is included in these materials?

These materials include this Proxy Statement for the Annual Meeting and our Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2021. We are first making these materials available to you on the Internet on or about April 20, 2022.

What is the purpose of the Annual Meeting?

For stockholders to vote on the following numbered proposals, and otherwise to transact any other business as may properly come before the Annual Meeting or at any adjournment or postponement thereof:

1.Election of Directors: To elect Lawrence D. Kingsley, Thomas D. Logan, Kenneth C. Bockhorst, Robert A. Cascella, Steven W. Etzel, John W. Kuo, Jody A. Markopoulos, Jyothsna (Jo) Natauri and Christopher Warren as directors for one-year terms;

2.Independent Director: To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022;

3.Say-on-Pay: To approve, on an advisory basis, the compensation of our named executive officers as disclosed in the accompanying proxy statement; and

4.Frequency of Say-on-Pay: To approve, on an advisory basis, the frequency (i.e., every one, two or three years) of future advisory votes to approve the compensation of our named executive officers.

How does the Board of Directors recommend I vote on these proposals?

The Board recommends that you vote FOR each of proposals 1, 2, and 3, and ONE YEAR for proposal 4.

Who is entitled to vote at the Annual Meeting?

Holders of our common stock as of the close of business on April 18, 2022 , the record date, may vote at the Annual Meeting. As of the record date, there were 199,533,232 shares of our Class A common stock and 8,560,540 shares of our Class B common stock outstanding. Each share of Class A and Class B common stock is entitled to one vote. Holders of our Class A common stock and Class B common stock will vote as a single class on all matters described in this proxy statement.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability of Proxy Materials was sent directly to you by us. As a stockholder of record, you may vote your shares in person at the Annual Meeting or by proxy as described below.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the "beneficial owner" of shares held in street name. The Notice and, upon your request, the proxy materials were forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your bank, broker or other nominee on how to vote your shares by following their instructions for voting.

How can I vote my shares?

If you are a stockholder of record, you may vote:

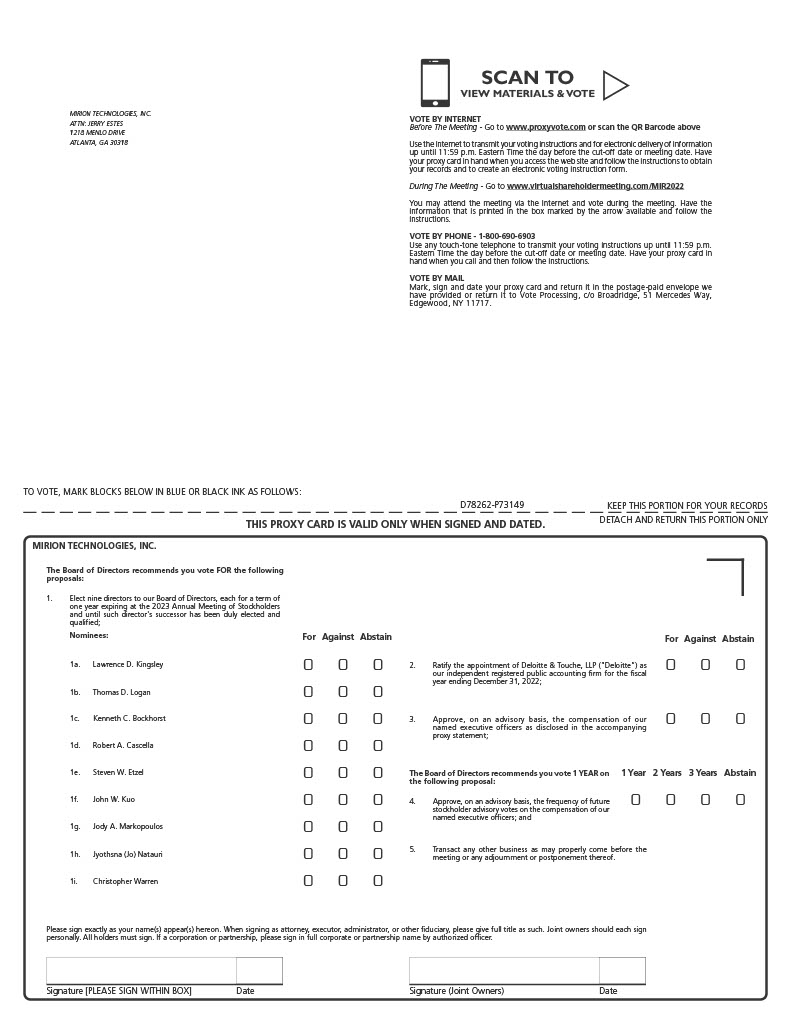

•Via the Internet. - Before The Meeting - Go to www.proxyvote.com or scan the QR Barcode above Use the Internet on your proxy card to transmit your voting instructions and for electronic delivery of information. Have your proxy card in

hand when you access the website and follow the instructions to obtain your record(s) and to create an electronic voting instruction form. Vote by 11:59 P.M. Eastern Time on Tuesday, June 14, 2022 for shares held directly.

•By Telephone. You may vote by proxy by calling 1-800-690-6903. Have your proxy card in hand when you call and then follow the instructions. Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 P.M. Eastern Time on Tuesday, June 14, 2022 for shares held directly.

•By Mail. You may vote by proxy by filling out the proxy card and returning it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

•During the Annual Meeting. All stockholders as of the close of business on the Record Date can vote at the Annual Meeting via the Annual Meeting website. There will not be a physical meeting location. Any stockholder of record as of the Record Date can attend the Annual Meeting webcast by visiting www.virtualshareholdermeeting.com/MIR2022 and vote during the meeting. The Annual Meeting starts at 10 a.m., Eastern Time. We encourage you to allow ample time for online check-in, which will open at 9:45 a.m., Eastern Time. Please have your 16-digit control number to join the Annual Meeting webcast. Instructions on who can attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/MIR2022.

Internet and telephone voting will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on Tuesday, June 14, 2022.

If you are a beneficial owner of shares held in street name, you should have received from your bank, broker or other nominee instructions on how to vote or instruct the broker to vote your shares, which are generally contained in a "voting instruction form" sent by the broker, bank or other nominee. Please follow their instructions carefully. Beneficial owners generally may vote:

•Via the Internet before the Annual Meeting. You may vote by proxy via the Internet at www.proxyvote.com up until 11:59 p.m Eastern Time Tuesday, June 14, 2022. Follow the directions on the voting instruction form provided to you by your broker, bank or other nominee.

•By Telephone. You may vote by proxy by calling 1-800-690-6903 up until 11:59 p.m Eastern Time Tuesday, June 14, 2022. Have the voting instruction form provided to you by your broker, bank or other nominee in hand when you call and follow the directions.

•By Mail. You may vote by proxy by filling out the voting instruction form and returning it in the envelope provided to you by your broker, bank or other nominee to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

•Virtually during the Annual Meeting. In order to vote during the Annual Meeting you must go to www.virtualshareholdermeeting.com/MIR2022 and enter the 16-digit control number found in the Proxy Materials. If you decide to attend the Annual Meeting, you will be able to vote using the link above, even if you have previously voted by Internet, Telephone or Mail.

If you received more than one Notice of Internet Availability of Proxy Materials or proxy card, then you hold shares of Mirion common stock in more than one account. You should vote via the Internet, by telephone, by mail or in person for all shares held in each of your accounts.

If I submit a proxy, how will it be voted?

When proxies are properly signed, dated and returned, the shares represented by the proxies will be voted in accordance with the instructions of the stockholder. If no specific instructions are given, you give authority to Lawrence D. Kingsley or Emmanuelle Lee to vote the shares in accordance with the recommendations of our Board as described above. If any director nominee is not able to serve, proxies will be voted in favor of the other nominee and may be voted for a substitute nominee, unless our Board chooses to reduce the number of directors serving on our Board. If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, then the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy.

Can I change my vote or revoke my proxy?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy before it is exercised by:

•Written notice to our Corporate Secretary;

•Timely delivery of a valid, later-dated proxy or a later-dated vote by telephone or on the Internet; or

•Voting in person at the Annual Meeting.

If you are a beneficial owner of shares held in street name, you should follow the instructions of your bank, broker or other nominee to change or revoke your voting instructions. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described above.

Can I attend the Annual Meeting?

You are invited to attend the Annual Meeting if you are a registered stockholder or a beneficial owner as of the record date or if you hold a valid proxy for the Annual Meeting. You can attend the Annual Meeting and vote your shares in person online during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/MIR2022. You will need the 16-digit control number that is printed on your proxy card to enter the Annual Meeting. If you are a beneficial owner and do not have your 16-digit control number, contact your banker, broker or other nominee. Please note that you will not be able to physically attend the Annual Meeting in person but may attend the Annual Meeting in person online.

Will I be able to ask questions at the Annual Meeting?

We are committed to ensuring that stockholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. Our directors and members of our management team will join the virtual meeting and be available for questions, and we are committed to answering all relevant questions we receive during the meeting. Stockholders may submit questions during the meeting through the virtual meeting platform at www.virtualshareholdermeeting.com/MIR2022 and enter the 16-digit control number found in their Proxy Materials. We will address questions after the voting is completed and the meeting is adjourned in order to minimize the potential impact of technical glitches on the proposals being voted upon. We will answer as many questions during the meeting as time permits, but if there are any questions that cannot be addressed due to time constraints or for any other reason (e.g., compliance with Regulation FD), we will post answers to such questions on our website following the meeting, when permissible. If we receive substantially similar questions, we may group them together and provide a single response to avoid repetition. Only questions that are relevant to the purpose of the Annual Meeting or our business will be answered.

What constitutes a quorum at the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority in voting power of the shares of our common stock issued and outstanding and entitled to vote at the Annual Meeting must be present or represented to conduct business at the Annual Meeting. You will be considered part of the quorum if you return a signed and dated proxy card, if you vote by telephone or Internet, or if you attend the Annual Meeting.

Abstentions and withhold votes are counted as "shares present" at the Annual Meeting for purposes of determining whether a quorum exists. Proxies submitted by banks, brokers or other holders of record holding shares for you as a beneficial owner that do not indicate a vote for some of or all the proposals because that holder does not have voting authority and has not received voting instructions from you (so-called "broker non-votes") are also considered "shares present" for purposes of determining whether a quorum exists. If you are a beneficial owner, these holders are permitted to vote your shares on the ratification of the appointment of our independent registered public accounting firm, even if they do not receive voting instructions from you.

What is the voting requirement to approve each of the proposals?

Provided that there is a quorum, the voting requirements are as follows:

| | | | | | | | |

| Proposal | Vote Required | Broker Discretionary

Voting Allowed? |

Election of directors | Plurality of votes cast | No |

Ratification of appointment of independent registered public accounting firm | Majority of votes cast | Yes |

| Say-on-Pay | Majority of votes cast | Yes |

| Frequency of Say-on-Pay | Majority of votes cast | Yes |

What is the impact of abstentions, withhold votes and broker non-votes?

Abstentions, withhold votes and broker non-votes are considered "shares present" for the purpose of determining whether a quorum exists, but will not be considered votes properly cast at the Annual Meeting and will have no effect on the outcome of the vote. Under the rules of the New York Stock Exchange, or NYSE, without voting instructions from beneficial owners, brokers will have discretion to vote on the ratification of the appointment of the independent registered public accounting firm but not on the election of directors. Therefore, in order for your voice to be heard, it is important that you vote.

Who pays for the cost of this proxy solicitation?

We will pay all the costs of preparing, mailing and soliciting the proxies. We will ask brokers, banks, voting trustees and other nominees and fiduciaries to forward the proxy materials to the beneficial owners of our common stock and to obtain the authority to execute proxies. We will reimburse them for their reasonable expenses upon request. In addition to

mailing proxy materials, our directors, officers and employees may solicit proxies in person, by telephone or otherwise. These individuals will not be specially compensated.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We also will disclose voting results on a Current Report on Form 8-K that we will file with the Securities and Exchange Commission, or SEC, within four business days after the Annual Meeting.

Why did I receive a Notice of Internet Availability of Proxy Materials rather than a full set of proxy materials?

In accordance with the SEC rules, we have elected to furnish our proxy materials, including this Proxy Statement and the Annual Report, primarily via the Internet rather than by mailing the materials to stockholders. The Notice of Internet Availability of Proxy Materials provides instructions on how to access our proxy materials on the Internet, how to vote, and how to request printed copies of the proxy materials. Stockholders may request to receive future proxy materials in printed form by following the instructions contained in the Notice of Internet Availability of Proxy Materials. We encourage stockholders to take advantage of the proxy materials on the Internet to reduce the costs and environmental impact of our Annual Meeting.

How can I obtain Mirion's Form 10-K and other financial information?

Stockholders can access our 2021 Annual Report, which includes our Form 10-K, and other financial information, on our website at http://www.ir.mirion.com under the caption "sec-filings." Alternatively, stockholders can request without charge a paper copy of the Annual Report (excluding exhibits) by writing to: Mirion Technologies, Inc., 1218 Menlo Drive, Atlanta, GA 30318, Attention: Corporate Secretary.

I share an address with another stockholder. Why did we receive only one set of Proxy Materials?

We may satisfy SEC rules regarding delivery of our Proxy Materials, including our proxy statement, or delivery of the Notice of Internet Availability of Proxy Materials by delivering a single copy of these documents to an address shared by two or more stockholders. This process is known as householding. To the extent we have done so, we have delivered only one set of the Proxy Materials or one Notice of Internet Availability of Proxy Materials, as applicable, to stockholders who share an address with another stockholder, unless contrary instructions were received prior to the mailing date. We undertake to promptly deliver, upon written or oral request, a separate copy of our proxy statement, our annual report including our Form 10-K for the fiscal year ended December 31, 2021 and/or our Notice of Internet Availability of Proxy Materials, as requested, to a stockholder at a shared address to which a single copy of these documents was delivered. To make such a request, please follow the instructions on our Notice of Internet Availability of Proxy Materials.

If your shares are held by a brokerage firm or bank and you prefer to receive separate copies of our proxy statement, our annual report including our Form 10-K for the fiscal year ended December 31, 2021 and/or our Notice of Internet Availability of Proxy Materials, either now or in the future, please contact your brokerage firm or bank. If your brokerage firm or bank is unable or unwilling to assist you, please contact our Investor Relations department at ir@mirion.com. Stockholders sharing an address who are receiving multiple copies of the Proxy Materials and/or our Notice of Internet Availability of Proxy Materials may request to receive a single copy of the Proxy Materials and/or our Notice of Internet Availability of Proxy Materials, either now or in the future, by contacting our Investor Relations department at ir@mirion.com.

When are stockholder proposals for inclusion in our Proxy Statement for next year's annual meeting due?

Stockholders wishing to present proposals for inclusion in our Proxy Statement for the 2023 annual meeting of stockholders (the “2023 Annual Meeting”) pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), must submit their proposals so that they are received by us at our principal executive offices no later than December 21, 2023. Proposals should be sent to our Corporate Secretary at 1218 Menlo Drive, Atlanta, GA 30318.

When are other proposals and stockholder nominations for the 2023 Annual Meeting due?

With respect to proposals and nominations not to be included in our Proxy Statement pursuant to Rule 14a-8 of the Exchange Act, our amended and restated bylaws (our “Bylaws”) provide that stockholders who wish to nominate a director or propose other business to be brought before the stockholders at an annual meeting of stockholders must notify our Secretary by a written notice, which notice must be received at our principal executive offices not less than 120 days nor more than 150 days prior to the first anniversary date of the immediately preceding year’s annual meeting of stockholders.

Stockholders wishing to present nominations for director or proposals for consideration at the 2023 Annual Meeting under these provisions of our Bylaws must submit their nominations or proposals so that they are received at our principal executive offices not later than February 15, 2023 and not earlier than January 16, 2023 in order to be considered. In the event that the date of the 2023 Annual Meeting is advanced more than 30 days prior to such anniversary date or delayed more than 70 days after such anniversary date then to be timely such notice must be received by the Company no earlier

than 120 days prior to the 2023 Annual Meeting and no later than the later of 70 days prior to the date of the 2023 Annual Meeting or the 10th day following the day on which public announcement of the date of the 2023 Annual Meeting was first made by the Company.

Nominations or proposals should be sent in writing to our Corporate Secretary at 1218 Menlo Drive, Atlanta, GA 30318. A stockholder’s notice to nominate a director or bring any other business before the Annual Meeting or the 2023 Annual Meeting must set forth certain information, which is specified in our Bylaws. A complete copy of our Bylaws is included as Exhibit 3.2 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Whom should I contact if I have additional questions?

You can contact our Investor Relations department at ir@mirion.com. Stockholders who hold their shares in street name should contact the organization that holds their shares for additional information on how to vote.

We make available, free of charge on our website, all of our filings that are made electronically with the SEC, including our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. These filings are available on the Investor Relations page of our corporate website at www.ir.mirion.com. Copies of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, including financial statements and schedules and amendments thereto filed with the SEC, are also available without charge to stockholders upon written request addressed to: Mirion Technologies, Inc., 1218 Menlo Drive, Atlanta, GA 30318, Attention: Investor Relations.

Non-GAAP Financial Measures

NON-GAAP FINANCIAL MEASURES

In addition to our results determined in accordance with generally accepted accounting principles (“GAAP”), this Proxy Statement includes certain non-GAAP financial measures that we believe are useful in evaluating our operating performance.

We believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. A reconciliation of the non-GAAP financial measures used in this Proxy Statement to the closest GAAP financial measure is included in Appendix A which is attached to this Proxy Statement.

Proposal No. 1 - Election of Directors

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Certificate of Incorporation provides that our Board must consist of the number of directors fixed from time to time by resolution of our Board. Our Board currently consists of nine members, each of whom has served since October 2021, when we became a public company. Each director holds office until a successor is duly elected and qualified or until his or her earlier death, resignation or removal. Each director must be elected annually by the stockholders and serves for a term ending on the date of the annual meeting of stockholders next following the annual meeting at which such director was elected.

The table below sets forth information with respect to our directors as of April 20, 2022:

| | | | | | | | |

| Name | Age | Position |

| Thomas D. Logan | 61 | Director, Founder and Chief Executive Officer |

| Lawrence D. Kingsley | 59 | Director and Chairman |

| Jyothsna (Jo) Natauri | 44 | Director |

| Christopher Warren | 46 | Director |

| Steven W. Etzel(1)(2) | 61 | Director |

| Kenneth C. Bockhorst(1)(3) | 49 | Director |

| Robert A. Cascella(2)(3) | 67 | Director |

| John W. Kuo(2)(3) | 58 | Director |

| Jody A. Markopoulos(1)(3) | 50 | Director |

(1) Member of the Audit Committee.

(2) Member of the Compensation Committee.

(3) Member of the Nominating and Corporate Governance committee.

Upon the recommendation of our Nominating and Corporate Governance Committee, our Board has nominated the entire Board for re-election. Biographical information for each director and director nominee is contained in the following section. If elected at the Annual Meeting, each of these nominees will serve for a one-year term expiring at the 2023 Annual Meeting of Stockholders and until his successor has been duly elected and qualified or until his earlier death, resignation or removal. Each person nominated for election has agreed to serve if elected, and we have no reason to believe that any nominee will be unable to serve. If any nominee is not able to serve, proxies will be voted in favor of the other nominee and may be voted for a substitute nominee, unless our Board chooses to reduce the number of directors serving on our Board. Unless otherwise instructed, the proxy holders will vote the proxies received by them "FOR" the re-election of all current directors.

Director Biographies

The following is a brief biographical summary of the experience of our directors and director nominees:

Thomas D. Logan currently serves, and has served, as Mirion’s founding Chairman and Chief Executive Officer since 2005, and he has served as a member of Mirion’s Board of Directors since 2005. Prior to joining Mirion, Mr. Logan served as Chief Executive Officer for Global Dosimetry Solutions, a radiation dosimetry provider, from 2004. Prior to 2004, Mr. Logan served as President of BAF Energy, CFO of E-M Solutions and of BVP, Inc. and prior to that, held various finance leadership positions at Chevron. Mr. Logan has more than 30 years of energy industry experience, as well as extensive experience within the contract manufacturing and consumer products industries. Mr. Logan received a M.B.A. and a B.S. from Cornell University. We believe Mr. Logan’s extensive history with Mirion, as well as his business expertise, qualify him to serve on our Board of Directors.

Lawrence D. Kingsley currently serves as the independent Non-Executive Board Chair of IDEXX Laboratories, Inc., a public company, since November 2019 and as an Advisory Director to Berkshire Partners LLC, an investment company, since May 2016. Mr. Kingsley also currently serves as a Director of Polaris Industries Inc., a public company, since January 2016. Prior to joining IDEXX Laboratories, Inc., Mr. Kingsley served as Chairman of Pall Corporation from

Proposal No. 1 - Election of Directors

October 2013 to August 2015 and as President and Chief Executive Officer of Pall Corporation from October 2011 to August 2015 until Danaher Corporation, a public company, acquired Pall Corporation in August 2015. Before his experience at Pall Corporation, Mr. Kingsley served as the Chief Executive Officer and President of IDEX Corporation, a public company specializing in the development, design and manufacture of fluid and metering technologies, health and science technologies and fire, safety and other diversified products, from March 2005 to August 2011, and the Chief Operating Officer of IDEX Corporation from August 2004 to March 2005. Mr. Kingsley previously served as a Director of Pall Corporation from October 2011 to August 2015, Cooper Industries plc (formerly Cooper Industries Ltd.), a public company, from 2007 to 2012 and IDEX Corporation from 2005 to 2011. He was also a director of Rockwell Automation, Inc. from 2013 to 2021. Mr. Kingsley served in various positions of increasing responsibility at Danaher Corporation, including Corporate Vice President and Group Executive from March 2004 to August 2004, President of Industrial Controls Group from April 2002 to July 2004 and President of Motion Group, Special Purpose Systems from January 2001 to March 2002. Mr. Kingsley also previously held management positions of increasing responsibility at Kollmorgen Corporation and Weidmuller Incorporated. Mr. Kingsley received an undergraduate degree in Industrial Engineering and Management from Clarkson University and an M.B.A. from the College of William and Mary. We believe that Mr. Kingsley’s strong executive leadership and operational skills, in-depth knowledge of and experience in strategic planning, corporate development, and operations analysis and experience serving on other public company boards provide him with the qualifications and skills to serve on our Board of Directors.

Jyothsna (Jo) Natauri is a Partner of Goldman Sachs & Co. LLC and has served as the Global Head of Private Healthcare Investing within Goldman Sachs Asset Management since May 2018. Prior to assuming her current role, Ms. Natauri was an investment banker with Goldman Sachs for 12 years, where she led coverage of large cap companies in healthcare and other industries. She was named managing director in 2008 and partner in 2012. Ms. Natauri has served as a director on the board of Flywire Corporation since November 2020, and also serves on the boards of MyEyeDr, Sita Foundation and Safe Horizon. She previously served on the board of Avantor from November 2018 to May 2021. Ms. Natauri received a B.A. from the University of Virginia in Economics and Biology. We believe that Ms. Natauri’s experience of over 20 years in covering companies and executing transactions provides her with the qualifications and skills to serve on our Board of Directors.

Christopher Warren currently serves, and has served, as a partner at Charterhouse Capital Partners LLP since he joined in 2013. Prior to joining Charterhouse, Mr. Warren served as a partner at ECI Partners, a private equity group, from 2003 to 2013. He also served as Associate at BC Partners, an international investment firm, and as Consultant at COBA, a UK-based strategy consulting firm. Mr. Warren received a Master of Arts in Philosophy, Politics and Economics from Oxford University and an MBA from INSEAD. We believe that Mr. Warren’s extensive business experience provides him with the qualifications and skills to serve on our Board of Directors.

Steven W. Etzel has served as Senior Vice President and Chief Financial Officer of Rockwell Automation, Inc., a company focused on industrial automation and information, from November 2020 to February 2021, and subsequently as Senior Vice President, Finance of Rockwell until his retirement in April 2021. Mr. Etzel joined Rockwell in 1989 and served in various positions, including Vice President and Treasurer from 2007 to 2020 and Vice President, Finance from October 2020 to November 2020. Mr. Etzel received his Bachelor of Science degree in Business Administration from Clarion University of Pennsylvania. Mr. Etzel is a CFA® charterholder. We believe Mr. Etzel’s extensive financial and management experience, including financial reporting, internal controls, investor relations, financial planning and analysis, capital markets financing transactions, mergers and acquisitions and risk management provides him with the qualifications and skills to serve on our Board of Directors.

Kenneth C. Bockhorst currently serves as the Chairman, President and Chief Executive Officer of Badger Meter, Inc., a global provider of industry leading smart water solutions that optimize operations and enhance sustainability across a wide range of customer applications. Mr. Bockhorst joined Badger Meter in October 2017 as Chief Operating Officer, was promoted to President in April 2018, Chief Executive Officer in 2019 and Chairman of the Board in 2020. Prior to Badger Meter, he served six years at Actuant Corporation, a diversified industrial company (now named Enerpac Tool Group), most recently as Executive Vice President of the Energy segment. Prior to Actuant, he held product management and operational leadership roles at IDEX and Eaton. Mr. Bockhorst received an M.B.A. from the University of Wisconsin - Madison and a B.A. from Marian University in Operations Management, Marketing and Human Resources. We believe Mr. Bockhorst's extensive operational experience with diversified industrial companies provides him with the qualifications and skills to serve on our Board of Directors.

Robert A. Cascella effective as of December 31, 2021 retired from the position of Strategic Business Development Leader for Royal Philips, a public Dutch healthcare company and has held this position since May 2020. From April 2015 to April 2020, he served as Executive Vice President and Chief Business Leader of Philips’ Diagnosis and Treatment and Precision Diagnosis businesses. He also served on Philip’s Executive Committee from January 2016 to April 2021. Prior to Philips, Mr. Cascella served at Hologic, Inc., a public medical device and diagnostics company, from February 2003 to December 2013 as its president and later CEO. He has also held senior leadership positions at CFG Capital, NeoVision Corporation and Fischer Imaging Corporation. Mr. Cascella has served as the chair of the board of Neuronetics, Inc. since April 2021, on the board of Metabolon, Inc. since September 2020 and on the board of Celestica Inc. since April 2019, where he has also served as chair of the Compensation Committee since July 2021. He previously served on the board of Tegra Medical and acted as chair of the boards of Dysis Medical and Miranda Medical. Mr. Cascella received a B.A. in

Proposal No. 1 - Election of Directors

accounting from Fairfield University. We believe Mr. Cascella's extensive medical device and healthcare business experience, as well as his experience serving on other public company boards, provide him with the qualifications and skills to serve on our Board of Directors.

John W. Kuo is the Chief Legal Officer of Visby Medical, a privately-held molecular diagnostic company, and has held such position since September 2021. Previously, he was the Executive Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary of Charles River Laboratories, a NYSE-listed, Fortune 1000 global contract drug research and development company, from May 2020 to September 2020. Before that, Mr. Kuo was the Senior Vice President, General Counsel and Corporate Secretary of Varian Medical Systems, a NYSE-listed, Fortune 1000 global cancer therapy/radiation therapy company, from July 2005 to May 2020. He also previously served in senior expatriate roles in Europe and Asia in the energy and high technology industries, respectively. Mr. Kuo received his J.D. from the University of California, Berkeley School of Law and his B.A. in Biology & Society from Cornell University. We believe that Mr. Kuo’s over 15 years of experience as an executive in Fortune 1000 life sciences companies, his familiarity with the radiation therapy industry, his global perspective and international market expansion experience, his deep understanding of regulated industries, his management experience in scaling global functions and his expertise in legal and corporate governance matters provide him with the qualifications and skills to serve on our Board of Directors.

Jody A. Markopoulos is currently an independent consultant. Previously, Ms. Markopoulos served as the Chief Operating Officer of Eos Energy Enterprises, Inc., a producer of low-cost battery storage solutions for the electric utility industry from March 2021 to November 2021. Previously, she spent 26 years in multiple operating leadership roles at General Electric and Baker Hughes. She served as the Chief Supply Officer at Baker Hughes, a GE company responsible for supply chain operations, from 2017 to 2018, and then as Chief Transition Officer from 2018 to 2020 responsible for executing the orderly transition from GE. At General Electric, she served as Chief Operations Officer at GE Oil & Gas from 2015 to 2017, President and CEO of GE Intelligent Platforms from 2011 to 2014 and as Vice President of Sourcing at GE Energy from 2005 to 2011. Ms. Markopoulos received a B.S. in Interdisciplinary Engineering and Management from Clarkson University. We believe Ms. Markopoulos’s experience as an operating executive qualifies her to serve as a director on our Board of Directors.

The Board recommends a vote "FOR" the election of Lawrence D. Kingsley, Thomas D. Logan, Kenneth C. Bockhorst, Robert A. Cascella, Steven W. Etzel, John W. Kuo, Jody A. Markopoulos, Jyothsna (Jo) Natauri and Christopher Warren.

CORPORATE GOVERNANCE

Board of Directors Leadership Structure

Our business and affairs are organized under the direction of the Board of Directors. Our Board recognizes that our success over the long term requires a robust and balanced governance framework and elected to maintain a separation between the positions of Chairman of the Board and CEO. In addition, because our Chairman is not independent, our Board of Directors adopted new Corporate Governance Guidelines that provide for the position of Lead Independent Director. Currently, Lawrence D. Kingsley is the Chairman of our Board, Thomas D. Logan is our CEO, and our Board of Directors appointed John W. Kuo as our Lead Independent Director.

The primary responsibilities of the Board of Directors are to provide oversight, strategic guidance, counseling and direction to management. The Board of Directors meets on a regular scheduled basis and also as required. Our Board regularly holds separate meetings for independent directors without management present. These meetings are generally held in conjunction with regularly scheduled meetings.

We believe this leadership structure is best for our company and our stockholders at this time. We believe there is good communication between management and our non-employee directors, and that our non-employee directors are able to carry out their oversight responsibilities effectively. The relatively small size of our Board and the relationship between management and non-employee directors put each director in a position to influence agendas, flow of information, and other matters.

Board Qualifications

Our Board has delegated to our Nominating and Corporate Governance Committee the responsibility for recommending to our Board the nominees for election as directors at the annual meeting of stockholders and for recommending persons to fill any vacancy on our Board. Our Nominating and Corporate Governance Committee selects individuals for nomination to our Board based on the following criteria. Nominees for director must:

•Possess fundamental qualities of intelligence, honesty, perceptiveness, good judgment, maturity, high ethics and standards, integrity, fairness and responsibility.

•Have a genuine interest in Mirion and recognition that as a member of our Board, each director is accountable to all of our stockholders, not to any particular interest group.

•Have a background that demonstrates an understanding of business and financial affairs.

•Have no conflict of interest or legal impediment that would interfere with the duty of loyalty owed to Mirion and our stockholders.

•Have the ability and be willing to spend the time required to function effectively as a director.

•Be compatible and able to work well with other directors and executives in a team effort with a view to a long-term relationship with Mirion as a director.

•Have independent opinions and be willing to state them in a constructive manner.

Directors are selected on the basis of talent and experience. Diversity of background, including diversity of gender, race, ethnic or geographic origin and age, and experience in business, management, industrial or healthcare sectors, computer software, and other areas relevant to our activities are factors in the selection process. As a majority of our Board must consist of individuals who are independent, a nominee's ability to meet the independence criteria established by the NYSE is also a factor in the nominee selection process.

In addition, we are a party to a director nomination agreement with certain entities affiliated with Charterhouse and a director nomination agreement with the Sponsor that provide Charterhouse with the right to nominate one director to our Board and the Sponsor to nominate two directors to our Board, subject to certain fallaway provisions. See “Certain Relationships and Related Transactions — Director Nomination Agreements” for more information.

For a better understanding of the qualifications of each of our directors, we encourage you to read their biographies set forth in this proxy statement.

Director Nominations

The Nominating and Corporate Governance Committee will consider candidates for director recommended by stockholders so long as the recommendations comply with our Certificate of Incorporation and Bylaws and applicable laws, rules and regulations, including those promulgated by the SEC. The Nominating and Corporate Governance Committee will evaluate such recommendations in accordance with its charter, our Bylaws, our corporate governance guidelines, and the regular board qualifications criteria described above. We are committed to diversity and inclusion, and the diverse nature of our Board reflects that commitment. We believe that a variety of experiences and points of view contributes to a more effective decision-making process. Stockholders wishing to recommend a candidate for nomination should comply with the procedures set forth in the section above entitled "Questions and Answers on Meeting and Voting - When are other proposals and stockholder nominations for the 2023 Annual Meeting due?"

Role of Board in Risk Oversight

Our Board has extensive involvement in the oversight of risk management related to us and our business and accomplishes this oversight through the regular reporting to the Board by the Audit Committee. The Audit Committee represents the Board by periodically reviewing our accounting, reporting and financial practices, including the integrity of our financial statements, the monitoring of administrative and financial controls and our compliance with legal and regulatory requirements. Through its regular meetings with management, including the finance, legal, internal audit and information technology functions, the Audit Committee reviews and discusses all significant areas of our business and summarizes for our Board all areas of risk and the appropriate mitigating factors. In addition, our Board receives periodic detailed operating performance reviews from management.

Board Meetings and Committees

The closing of the Business Combination occurred on October 20, 2021 and our Board met two times during 2021. Our Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which has the composition and responsibilities described below. Members serve on these committees until their resignation or until otherwise determined by the Board. Each committee is governed by a written charter. In 2021, each director attended at least 75% of the meetings of the Board and the committees on which they serve. Each committee charter is posted on our website at http://ir.mirion.com/corporate-governance. From time to time, our Board may also establish other, special committees when necessary to address specific issues.

Audit Committee

Our Board’s Audit Committee met one time in 2021. Our Audit Committee consists of Steven W. Etzel, Kenneth C. Bockhorst and Jody A. Markopoulos, with Steven W. Etzel serving as the chair of the committee. Our Board has determined that Steven W. Etzel, Kenneth C. Bockhorst and Jody A. Markopoulos are “independent” as defined under applicable NYSE listing standards, including the standards specific to members of an Audit Committee, and Rule 10A-3 of the Exchange Act, and are financially literate.

Our Board has also determined that Steven W. Etzel qualifies as an Audit Committee financial expert within the meaning of SEC regulations and meets the financial sophistication requirements of the NYSE listing rules. In making this determination, our Board considered Steven W. Etzel’s formal education and previous and current experience in financial and accounting roles. Our independent registered public accounting firm and management periodically will meet privately with the Audit Committee.

The Audit Committee is responsible for, among other things:

•appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm;

•discussing with our independent registered public accounting firm their independence;

•reviewing with our independent registered public accounting firm the scope and results of their audit;

•approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm;

•overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC;

•reviewing our policies on risk assessment and risk management;

•reviewing related party transactions;

•designing and implementing the internal audit function;

•overseeing our financial and accounting controls and compliance with legal and regulatory requirements; and

•establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters.

Compensation Committee

Our Board’s Compensation Committee met one time in 2021. Our Compensation Committee consists of Robert A. Cascella, Steven W. Etzel and John W. Kuo, with Robert A. Cascella serving as the chair of the committee. Robert A. Cascella, Steven W. Etzel and John W. Kuo are non-employee directors, as defined in Rule 16b-3 promulgated under the Exchange Act. Our Board has determined that Robert A. Cascella, Steven W. Etzel and John W. Kuo are “independent” as defined under applicable NYSE listing standards, including the standards specific to members of a Compensation Committee.

The Compensation Committee is responsible for, among other things:

•determining, or recommending to our Board for determination, the compensation of our executive officers, including the chief executive officer;

•administering our equity compensation plans;

•overseeing our overall compensation policies and practices, compensation plans, and benefits programs; and

•appointing and overseeing any compensation consultants.

We believe that the composition and functioning of the Compensation Committee meets the requirements for independence under applicable NYSE listing standards.

Nominating and Corporate Governance Committee

Our Board’s Nominating and Corporate Governance Committee met one time in 2021. Our Nominating and Corporate Governance Committee consists of John W. Kuo, Kenneth C. Bockhorst, Robert A. Cascella and Jody A. Markopoulos, with John W. Kuo serving as the chair of the committee. Our Board has determined that each of these individuals is “independent” as defined under applicable SEC rules and NYSE listing standards.

The Nominating and Corporate Governance Committee is responsible for, among other things:

•evaluating and making recommendations regarding the composition, organization and governance of our Board and its committees;

•reviewing and making recommendations with regard to our corporate governance guidelines and compliance with laws and regulations;

•Environmental, Social and Governance ("ESG") oversight; and

•spearheading an evaluation of our Board and its committees.

We believe that the composition and functioning of the Nominating and Corporate Governance Committee meets the requirements for independence under current NYSE listing standards.

The audit, compensation, and Nominating and Corporate Governance Committees each operate under a written charter that satisfies the applicable rules and regulations of NYSE and the SEC.

We have posted the charters of our Board’s audit, compensation and Nominating and Corporate Governance Committees, and we intend to post any amendments thereto that may be adopted from time to time, on our website at https://ir.mirion.com/corporate-governance/governance-documents. Our Board may from time to time establish other committees.

Lead Independent Director

Our independent directors have appointed John W. Kuo as Lead Independent Director. The Lead Independent Director position includes the following responsibilities:

•lead the executive sessions of the independent directors;

•serve as a liaison between the Chair of the Board and/or the CEO and the independent directors,

•review and approve the agendas for the regular meetings of the Board, and

•preside at all meetings of the Board where the Chair is absent.

The Lead Director may be removed or replaced at any time with or without cause by a majority vote of the independent directors then in office.

Code of Ethics and Business Conduct

We have adopted a Code of Ethics and Business Conduct that applies to all of our employees, officers, and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The full text of our Code of Ethics and Business Conduct is available on the investor relations page on our website at https://ir.mirion.com/corporate-governance/governance-documents. We will post any amendments to our Code of Ethics and Business Conduct on the same website.

Governance Documents

We believe that good corporate governance is important to ensure that Mirion is managed for the long-term benefit of our stockholders. Our Nominating and Corporate Governance Committee will periodically review and reassess our Corporate Governance Guidelines and overall governance structure. Complete copies of our current Board committee charters and our Corporate Governance Guidelines and our Code of Business Conduct and Ethics are available on our investor relations website, at https://ir.mirion.com/corporate-governance/governance-documents. We will post any amendments on the same website.

Director Independence

Our Board has undertaken a review of the independence of each director. Based on information provided by each director concerning his background, employment and affiliations, our Board has determined that none of our current directors have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is "independent" as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the NYSE. In making this determination, our Board considered the current and prior relationships that each non-employee director has with Mirion and all other facts and circumstances that our Board deemed relevant in determining their independence, including the beneficial ownership of our common stock by each non-employee director and the transactions involving them described under "Certain Relationships and Related Party Transactions."

Related-Party Policy

Our Audit Committee has the primary responsibility for reviewing and approving or ratifying transactions with related parties. Our Audit Committee has adopted a formal Related-Party Policy, pursuant to which the Audit Committee reviews all transactions which in which the Company or any of its subsidiaries, was, is, or will be a participant, the amount of which exceeds $120,000 and in which any related party had, has or will have a direct or indirect material interest. The Audit Committee must approve or ratify any covered related-party transaction for it to be consummated or continue.

The Audit Committee reviews these related-party transactions as they arise and are reported to the Audit Committee. The Audit Committee also reviews materials prepared by our Board and our executive officers to determine whether any related-party transactions have occurred that have not been reported. In reviewing any related-party transaction, the Audit Committee is to consider all relevant facts and circumstances, including the aggregate dollar value of the transaction, the related party's relationship to us and interest in the transaction, and the benefits to us of the transaction. The Audit Committee determines, in its discretion, whether the proposed transaction is in the best interests of Mirion and our stockholders.

For more information, please see below "Certain Relationships and Related Party Transactions - Related Party Policy."

Compensation Committee Interlocks and Insider Participation

None of our executive officers currently serves, or has served during the last year, as a member of the Board of Directors or Compensation Committee of any entity that has one or more executive officers serving as a member of our Board.

Communications with Directors

Interested parties may communicate with our Board or with an individual director by writing to our Board or to the particular director and mailing the correspondence to: Mirion Technologies, Inc., 1218 Menlo Drive, Atlanta, GA 30318, Attention: Corporate Secretary. The Corporate Secretary will promptly relay to the addressee all communications that he determines require prompt attention and will regularly provide our Board with a summary of all substantive communications.

DIRECTOR COMPENSATION

As discussed below under "Executive Compensation - Business Highlights", we began trading as a public operating company on the NYSE on October 21, 2021, following the closing of the merger agreement that resulted in the combination of GS Acquisition Holdings Corp II ("GSAH") and Mirion. Prior to the closing of the Business Combination, our directors did not otherwise receive any additional compensation for their service in their capacity as directors except for the grant of profits interests to Mr. Kingsley as set forth above. In connection with the Business Combination, we implemented a new director compensation program (the “Director Compensation Program”). Pursuant to the Director Compensation Program, non-employee directors will receive the following cash compensation, paid quarterly in arrears, for their service as members of the Board and certain sub-committees thereof:

| | | | | |

| Position | Annual Retainer |

| Board Service | $76,500 |

| plus (as applicable): | |

| Audit Committee Chair | $10,000 |

| Compensation Committee Chair | $10,000 |

| Nominating/Governance Committee Chair | $10,000 |

In lieu of cash, non-employee directors may elect to receive full payment of their retainers in shares of our common stock on a quarterly basis. Payment of retainers in a combination of cash and stock is not permitted.

In addition, non-employee directors will receive grants of equity awards under the Incentive Plan. Each year, the Board or Compensation Committee will provide each non-employee director who will continue to serve on the Board with a grant of restricted stock units (“RSUs”) with an approximate grant date fair market value of $93,500. These annual equity awards vest quarterly and will be fully vested on the first anniversary of the grant date, subject to the non-employee director’s continued service on the Board through each such vesting date. A non-employee director who is elected or appointed to the Board at any time other than at the annual stockholder meeting will, at the time of such election or appointment, receive an award of RSUs with a grant date fair market value equal to the product of $93,500 multiplied by a fraction (i) the numerator of which is equal to the number of days between the date of the director’s initial election or appointment to the Board and the date which is the first anniversary of the date of the most recent annual stockholder meeting occurring before the new non-employee director is elected or appointed to the Board, and (ii) the denominator of which is 365.

Each of Jyothsna (Jo) Natauri and Christopher Warren have agreed to waive compensation under the Director Compensation Program. The Director Compensation Program also provides that the Company will reimburse non-employee directors for their ordinary, necessary and reasonable out-of-pocket travel expenses to cover in-person attendance at and participation in Board meetings, in accordance with the Company’s applicable expense reimbursement policies and procedures as in effect from time to time.

Director Compensation Table

The following table summarizes the compensation of our non-employee directors who served during 2021, it sets forth a summary of the compensation we paid to each non-employee member of our Board for the period beginning July 1, 2020 and ending December 31, 2021. During the Prior Fiscal Year, the only non-employee director who received compensation was Mr. Kingsley, whose only compensation was the granting of profits interests by GS Sponsor II LLC (" Sponsor"). Other than as set forth in the table and described more fully below, we did not pay any compensation to, make any equity awards or non-equity awards to, or pay any other compensation to any of the other non-employee members of our Board in 2021.

Jyothsna (Jo) Natauri and Christopher Warren receive no compensation in connection with their service as directors and, accordingly, they are omitted from this table. Thomas Logan is our CEO and he receives no compensation for his services as director, his CEO compensation is reported in the Summary Compensation Table below under "Executive Compensation."

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name(1) | | Fees Earned or Paid in Cash ($)(1) | | Stock Awards ($)(2)(3) | | All Other Compensation ($) | | Total ($) |

| Kenneth C. Bockhorst | | 15,175 | | 60,962 | | — | | 76,137 |

| Robert Cascella | | 17,159 | | 60,962 | | — | | 78,121 |

| Steven W. Etzel | | 17,159 | | 60,962 | | — | | 78,121 |

| Lawrence D. Kingsley | | 15,175 | | 32,526,962 (4) | | — | | 32,542,137 |

| John W. Kuo | | 17,159 | | 60,962 | | — | | 78,121 |

| Jody A. Markopoulos | | 15,175 | | 60,962 | | — | | 76,137 |

(1) The amounts reported in this column represent the aggregate dollar amount of all fees earned or paid in cash to each non-employee director in fiscal year 2021 for their service as a director, including any annual retainer fees, committee and/or chair fees.

(2) The amounts shown in this column relate to the pro rata annual RSU grant made to certain non-employee directors, as further described below under the heading “Director Compensation.” For the RSUs, the amounts reported in this column represent the grant date fair value of RSUs calculated in accordance with the provisions of ASC Topic 718.

(3) As of December 31, 2021, the number of shares underlying outstanding restricted stock units held by each of our non-employee Directors were as follows:

| | | | | |

| Name | Aggregate Number of Shares Underlying Restricted Stock Units |

| Kenneth C. Bockhorst | 5,817 |

| Robert Cascella | 5,817 |

| Steven W. Etzel | 5,817 |

| Lawrence D. Kingsley | 5,817 |

| John W. Kuo | 5,817 |

| Jody A. Markopoulos | 5,817 |

| Jyothsna (Jo) Natauri | - |

| Christopher Warren | - |

(4) Value includes the grant date value of a one-time grant of profits interests in the Sponsor, which was approved and granted by the Sponsor in recognition of Mr. Kingsley’s efforts in connection with the Business Combination. As discussed below under “Executive Compensation—Profits Interests,” the Sponsor granted Mr. Kingsley the award of profits interests on June 16, 2021 in connection with the signing of the Business Combination Agreement. The profits interests award provides for service and performance-vesting, with the award only vesting upon the achievement of specified share price conditions. The grant date fair value of the profits interests is based upon a valuation model using Monte Carlo simulations in accordance with ASC Topic 718. Mr. Kingsley also received a pro rata annual RSU grant with a grant date fair value of $60,962, consistent with all other non-employee directors.

Ownership of Common Stock

OWNERSHIP OF COMMON STOCK

BENEFICIAL OWNERSHIP

The following table sets forth information known to us regarding the beneficial ownership of our common stock as of April 18, 2022 by:

•each person who is known by us to be the beneficial owner of more than 5% of the outstanding shares of the Class A common stock;

•each current executive officer and director of the Company; and

•all executive officers and directors as a group.

The information below is based on an aggregate of 199,533,232 shares of Class A common stock and 8,560,540 shares of Class B common stock issued and outstanding as of April 18, 2022. Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if she, he or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days or equity awards that are expected to settle or vest within 60 days. Unless otherwise indicated, the Company believes that all persons named in the table below have sole voting and investment power with respect to all shares of common stock beneficially owned by them:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Address of Beneficial Owners(1)(2) | | Number of Shares of Class A Common Stock | | Ownership Percentage of Class A Common Stock (%) | | Number of Shares of Class B Common Stock | | Ownership Percentage of Class B Common Stock (%) | | Ownership Percentage of Common Stock (%) |

5% Holders (Other than Directors and Executive Officers) | | | | | | | | | | |

GS Sponsor II LLC(3)(4) | | 24,525,000 | | 11.8% | | — | | — | | 11.3% |

GSAM Holdings LLC(3)(4) | | 46,750,000 | | 22.5% | | — | | — | | 21.6% |

GSAH II PIPE Investors Employee LP(5) | | 17,199,900 | | 8.6% | | — | | — | | 8.3% |

Alyeska Investment Group, L.P. (6) | | 14,939,633 | | 7.4% | | — | | — | | 7.1% |

Charterhouse Parties(7) | | 24,746,855 | | 12.4% | | — | | — | | 11.9% |

Directors and Executive Officers | | | | | | | | | | |

Thomas D. Logan(8) | | — | | — | | 4,140,388 | | 48.4 | | 2.0% |

Lawrence D. Kingsley(9) | | 505,817 | | | * | | — | | | — | | * |

Brian Schopfer(10) | | — | | — | | 740,845 | | 8.7 | | * |

Loic Eloy | | 169,868 | | * | | | | | | * |

Jyothsna (Jo) Natauri(11) | | — | | — | | — | | — | | — |

Christopher Warren | | — | | — | | — | | — | | — |

Steven W. Etzel (12) | | 8,428 | | | * | | — | | — | | * |

Kenneth C. Bockhorst (12) | | 8,126 | | | * | | — | | — | | * |

Robert A. Cascella (12) | | 5,817 | | | * | | — | | — | | * |

John W. Kuo (12) | | 8,428 | | | * | | — | | — | | * |

Jody A. Markopoulos (12) | | 8,126 | | | * | | — | | — | | * |

All directors and executive officers as a group (11 individuals) | | 701,122 | | | * | | 4,881,233 | | | 57.0 | | 2.7 |

Ownership of Common Stock

| | | | | |

(1) | Unless otherwise noted, the business address of each of the following entities or individuals is Mirion Technologies, Inc., 1218 Menlo Drive, Atlanta, Georgia 30318. |

(2) | The shares of our Class B common stock are paired, one-for-one, with shares of IntermediateCo Class B common stock. Such paired interests may be redeemed by the holder and, at our option, settled by a one-for-one exchange for shares of Class A common stock or a cash amount per share based on an average trailing stock price of Company Class A common stock. See “Certain Relationships and Related Transactions, and Director Independence—IntermediateCo Charter.” The founder shares are subject to certain vesting conditions upon a Founder Share Vesting Event. Holders of the founder shares are entitled to vote such founder shares and receive dividends and other distributions with respect to such founder shares prior to vesting, but such dividends and other distributions with respect to unvested founder shares will be set aside by the Company and shall only be paid to the holders of the founder shares upon the vesting of such founder shares. The founder shares will be forfeited to the Company for no consideration if they fail to vest on or before October 20, 2026. |

(3) | GSAM Holdings LLC is the managing member of GS Sponsor II LLC. GSAM Holdings LLC is a wholly owned subsidiary of The Goldman Sachs Group, Inc. In addition to the shares held by GS Sponsor II LLC, GS Acquisition Holdings II Employee Participation LLC (“Participation LLC”) and GS Acquisition Holdings II Employee Participation 2 LLC (“Participation 2 LLC”), each of which is managed by a subsidiary of GSAM Holdings LLC, directly owns 1,325,000 founder shares and 1,400,000 founder shares, respectively. Each of GSAM Holdings LLC and The Goldman Sachs Group, Inc. may be deemed to beneficially own the shares held by GS Sponsor II LLC, Participation LLC and Participation 2 LLC by virtue of their direct and indirect ownership, as applicable, over GS Sponsor II LLC, Participation LLC and Participation 2 LLC. Each of GSAM Holdings LLC and The Goldman Sachs Group, Inc. disclaims beneficial ownership of any such shares except to the extent of their respective pecuniary interest therein. Further, each of GSAM Holdings LLC and The Goldman Sachs Group, Inc. may be deemed to beneficially own the shares held by the PIPE Participation LLCs (as defined below) but disclaims beneficial ownership of any such shares except to the extent of its pecuniary interest therein. |

(4) | Interests shown for GS Sponsor II consist of (i) 16,025,000 founder shares and (ii) 8,500,000 shares of Class A common stock underlying the private placement warrants. Interests shown for GSAM Holdings consist of (i) 18,750,000 founder shares, (ii) 8,500,000 shares of Class A common stock underlying the private placement warrants and (iii) 19,500,000 shares of Class A common stock held by the PIPE Participation LLCs. |